Share the knowledge, grow the community, empower each other!

School Reopening: Tax-Free Weekend and More

As the summer days gradually wind down, it's time for parents and students to gear up for another school year. The prospect of school reopening brings a blend of excitement and preparation. It's that time of the year when backpacks, notebooks, pencils, and textbooks become the talk of the town. But before you dive into the hustle and bustle of back-to-school shopping, here's a valuable tip: make the most of the upcoming tax-free weekend.

Tax-Free Weekend: A Boon for Parents

Mark your calendars because tax-free weekends are a golden opportunity for parents to stock up on school supplies without the burden of sales tax. This annual event, held in many states across the country, allows families to purchase essential items like clothing, footwear, and school supplies without paying sales tax. It's a budget-friendly way to ensure your kids are well-prepared for the upcoming academic year.

During this special weekend, which typically falls in August, you can enjoy substantial savings on a wide range of items. From backpacks and notebooks to computers and uniforms, the tax-free weekend covers an array of necessities that students require. This initiative aims to alleviate some of the financial stress that often accompanies back-to-school preparations.

Smart Tips for Back-to-School Readiness

While the tax-free weekend is a fantastic opportunity to save money, being fully prepared for the school reopening involves more than just shopping. Here are some additional tips to ensure a smooth transition:

1. Review School Requirements: Different schools may have varying requirements for supplies and uniforms. Check with your child's school to get a clear list of what is needed for the upcoming year.

2. Create a Shopping List: Before hitting the stores, make a comprehensive shopping list. This will help you stay focused and avoid unnecessary purchases.

3. Set a Budget: Back-to-school shopping can quickly add up. Set a budget and stick to it to ensure you don't overspend.

4. Shop Early: Take advantage of the tax-free weekend by shopping early. The stores can get crowded, so starting your shopping early will help you avoid the last-minute rush.

5. Explore Online Options: Consider shopping online for convenience and to access a wider range of products. Many online retailers also participate in the tax-free weekend.

6. Check for Deals: In addition to tax-free savings, keep an eye out for special deals and promotions offered by retailers during this period.

7. Quality over Quantity: While it's tempting to buy in bulk, prioritize quality over quantity. Invest in durable items that will last throughout the school year.

8. Involve Your Child: Get your child involved in the shopping process. It's a great way to teach them about budgeting and decision-making.

9. Healthy Habits: Prepare your child for the school routine by gradually adjusting their sleep schedule and encouraging healthy eating habits.

https://taxadmin.org/sales-tax-holidays/

#SettleWiseStance – The school reopening season is an exciting time for both parents and students. By taking advantage of the tax-free weekend and following these tips, you can ensure a smooth and cost-effective transition. So, get ready to embark on the back-to-school journey with enthusiasm and readiness. Your child's new academic adventures await!

Remember, the tax-free weekend is not only an opportunity to save money but also a chance to bond with your child over the exciting process of preparing for the school year ahead. Make the most of it and enjoy the thrill of gearing up for another year of growth and learning.

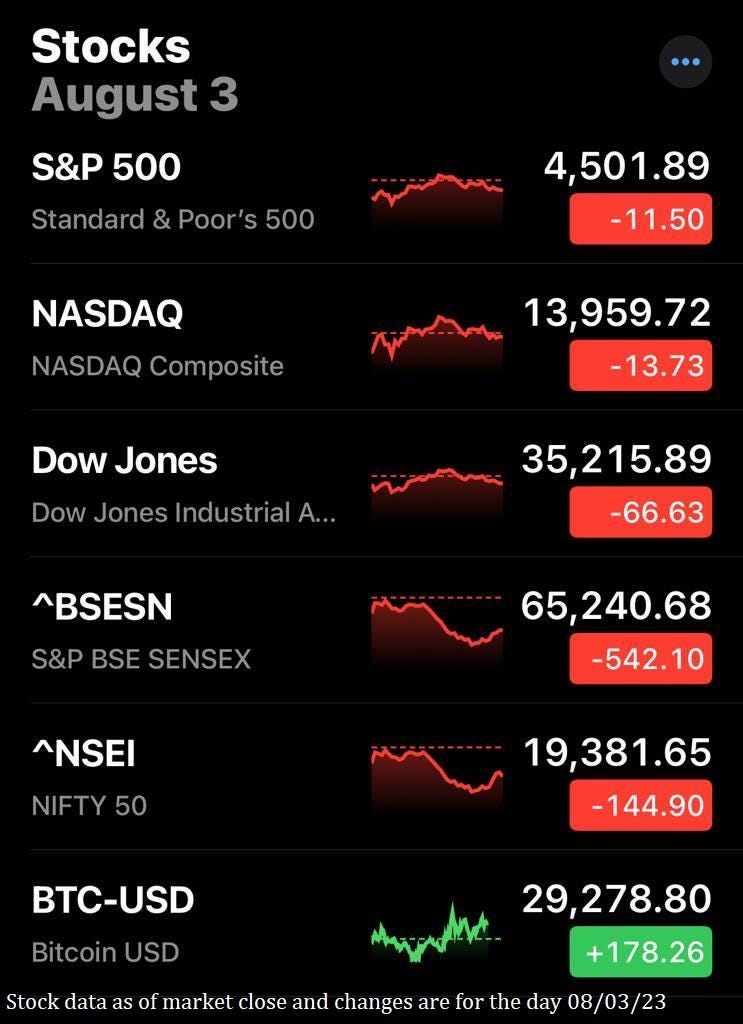

Fitch Downgrades United states from AAA to AA+.

We understand that staying informed about changes in the US economy is crucial for all of you, especially immigrants navigating new financial landscapes. We want to shed light on a recent development that might impact your financial decisions.

Fitch Ratings, one of the three major global credit rating agencies, recently downgraded the United States' long-term foreign currency ratings from AAA to AA+. This decision was rooted in concerns about an expected fiscal deterioration over the next three years and an erosion of governance. While this might sound technical, it has significant implications for various aspects of your financial life.

You might be wondering, why does a credit rating downgrade matter? While some might view it as a minor shift from A+ to A in school, for Indian parents, it holds monumental importance. Similarly, the downgrade from AAA to AA+ carries significant implications.

Now, you might be wondering, what's the connection between our report card memories and this credit rating downgrade? Well, let's break it down. The US credit rating is like its financial report card, indicating how reliable it is to lend money to the government. A AAA rating is like the highest honor roll, signifying the lowest risk. But a shift to AA+ doesn't mean we're in financial trouble. It's more like moving from a super impressive A+ to a still awesome A.

So, why should you care? Here's where it gets interesting. This downgrade could have a ripple effect on something that impacts our wallets - the USD to INR exchange rate. Just like your parents believed that A+ reflected your potential, a AAA rating reassured global investors about the US' financial health. With the rating adjustment, some investors might feel a tad less certain, which could influence the exchange rate.

Now, hold on a second, this isn't a time to panic. We immigrants are known for our resilience, and Settlewise is here to guide you through these economic waves. It's an opportunity to sharpen our financial smarts. Understanding these shifts empowers you to make informed decisions about your money matters.

Remember, it's not about dwelling on the downgrade; it's about knowing what it means and how it might affect your financial choices. So, let's make the most of this chance to learn, adapt, and thrive!

Is this happening for first time? No. This isn't the first time such a downgrade has occurred; the last instance was in 2011 after the Great Recession. The downgrade may affect the confidence in the US economy and the demand for US dollars, which could lead to a lower exchange rate. However, other factors such as inflation rates, interest rates and economic growth rates may also influence the exchange rate. Former Treasury Secretary Larry Summers called the downgrade “absurd” and current Treasury Secretary Janet Yellen called it “arbitrary and based on outdated data.” They argued that the US economy is resilient and strong.

#SettleWiseStance – To put it simply, a downgrade could lead to higher interest rates on loans and credit cards, affecting your monthly payments and financial planning. While this doesn't necessarily mean dire consequences, it's crucial to stay informed and financially prepared. It may not be immediate impact to currency exchange and can’t say it will impact for sure either. All we can do is stay informed, stay prepared, and continue building your financial knowledge. Together, we can navigate these changes and work towards a secure financial future.

Wiser Craving

Multiple subscribers reached out expressing their interest of learning few specific topics. If you want to read about any specific topic, Please let me know in the comments or email to author.settlewise@gmail.com

#WiserCraving Topic of this edition is Traffic Ticket.

Navigating Traffic Tickets: Beyond the Payment

Getting a traffic ticket can be a frustrating experience, but it's important to remember that paying the fine is not the only course of action available. In fact, settling the ticket might have more significant consequences than you realize. Beyond the immediate financial hit, there's the lasting impact on your insurance premiums. However, there's a silver lining – hiring an attorney to handle your case can lead to more favorable outcomes and even a ticket-free record. Let's explore why paying the ticket isn't your only option and how legal intervention can help you navigate through the complexities.

Understanding the Consequences:

While the initial fine associated with a traffic ticket might seem manageable, there's more to consider. One of the most significant and lasting impacts is on your insurance premiums. Even a minor violation can lead to an increase in your insurance rates for at least three years. This can result in substantial financial strain over time, far exceeding the initial ticket cost.

Exploring Alternatives:

Before hastily paying the fine, it's wise to explore alternatives. Hiring an experienced traffic attorney can provide you with a range of options beyond paying the ticket. Attorneys are skilled in evaluating your case and devising strategies to potentially have the charges dismissed or reduced. This approach not only saves you money in the long run but also prevents a blemish on your driving record that could affect your insurance premiums.

The Power of Going to Trial:

One effective strategy an attorney can employ is taking your case to trial. Many individuals are unaware of the potential to contest their traffic violations in court. Attorneys can scrutinize the evidence, challenge the legality of the stop, or question the accuracy of speed-measuring devices. This rigorous approach can lead to having your case dismissed entirely.

Exploring Plea Deals:

In cases where going to trial might not be the best option, your attorney can negotiate a plea deal. This could involve a period of probation or attending driving school. Successfully completing the terms of the plea deal can result in having the ticket removed from your record, saving you from insurance premium hikes.

#SettleWiseStance – It is a myth that hiring an attorney is more expensive than paying a traffic fine. According to Bigger & Harman, APC, hiring an attorney can be around $1500-$2000 cheaper over the three-year period, depending on the attorney’s fees. The calculation of the three-year premium increase comes to a total of $2000 which is way more expensive compared to the attorney fee of $150-$200.

FREE chance to win 1.25 Billion!

Hold onto your seats as the Mega Millions jackpot skyrockets to an astonishing $1.25 Billion – yes, you heard it right, a BILLION! The stakes have never been higher, and the potential for life-altering fortunes has never been this extraordinary. With every pulse-pounding draw, the jackpot surges, defying all limits and redefining the realm of possibility. SettleWise is providing an exclusive FREE play offer, granting you a golden opportunity to dive headfirst into the frenzy of these jaw-dropping jackpots without spending a dime. Don't let this heart-pounding moment pass you by. Claim your FREE play now and unleash your luck. Good luck, fortune-seekers! Don't miss out on this incredible opportunity – click the link to claim your free play and who knows, you could be the next big winner! Good Luck.

Click for a FREE PLAY https://jackpocket.com/

We value your feedback! Please take a moment to share your thoughts on this episode and let us know what topics you would like to read about next. Your input guides us in delivering valuable and relevant content. Feel free to leave your feedback in the comments below.

Thanks for reading SettleWise! Was this email forwarded to you? That's wonderful! It shows how much they value you and believe that you would benefit from the content. Subscribe for free to receive new posts and support my work.

Disclaimer: I am not a certified professional in the fields discussed. The content provided in this article is for educational and entertainment purposes only. The opinions and suggestions shared are intended to provide general information and assist you in making informed decisions. Please note that while I may mention specific products or services, I may earn referral income from some of the links provided, but no additional cost to you. Therefore, while you can continue reading and absorbing the information, please exercise your own judgment and seek professional advice when necessary. Please gamble responsibly and with caution, as playing the lottery involves chance and there are no guaranteed outcomes