Share the knowledge, grow the community, empower each other!

Recapturing 230,000 Unused Green Cards

We have exciting news to share with you today regarding the recapturing of unused green cards. Amidst the recent date retrogressions across various categories, including EB-1 (Retrogressed 10 year to ) in Aug visa bulletin, the proposed recapturing of unused green cards brings a ray of hope and relief to thousands eagerly awaiting. The U.S. President's Advisory Commission has given the green light to a recommendation that more than 230,000 unused green cards from family and employment categories, dating back to 1992, be recaptured. This decision is particularly beneficial for the Indian American community eagerly awaiting their green cards.

The recapturing of green cards aims to address bureaucratic delays and provide relief to individuals who have been waiting in backlog. JJ Pretoria, a member of Joe Biden's Advisory Commission on Asian Americans, Native Hawaiians, and Pacific Islanders, explained that the recapturing process involves gradually processing a portion of the 230,000 unused employment-based green cards each fiscal year, in addition to the annual limit of 140,000 allocated for this category.

The need for recapturing these green cards stems from the impact of the backlog on temporary workers holding H-1B visas. The lack of a green card hampers their mobility and restricts their contributions to the U.S. economy. Additionally, their children face the risk of aging out of their immigration status once they turn 21.

For individuals who have experienced the frustration of having their priority dates become current, only to have them retrogress and be left in a state of uncertainty, there is finally a glimmer of hope on the horizon.

Imagine the relief and excitement that would come with seeing your priority date once again become current, signaling that you are one step closer to obtaining your long-awaited green card. This development has the potential to bring immense joy and relief to countless individuals and families who have been enduring the lengthy and uncertain journey towards permanent residency.

Since this initiative can be approved by the President through an executive order, it bypasses the need for congressional approval, bringing us one step closer to a tangible solution for individuals who have faced retrogression and those whose priority dates have seemed unattainably distant. Hope is renewed as the path to obtaining a green card becomes clearer and more within reach.

#SettleWiseStance – With the potential realization of green card recapture, a ray of hope shines upon those who have experienced retrogression in their I-485 applications and individuals whose priority dates seemed impossibly distant, fueling optimism that their dream of obtaining a green card may soon become a reality. 🤞🏼

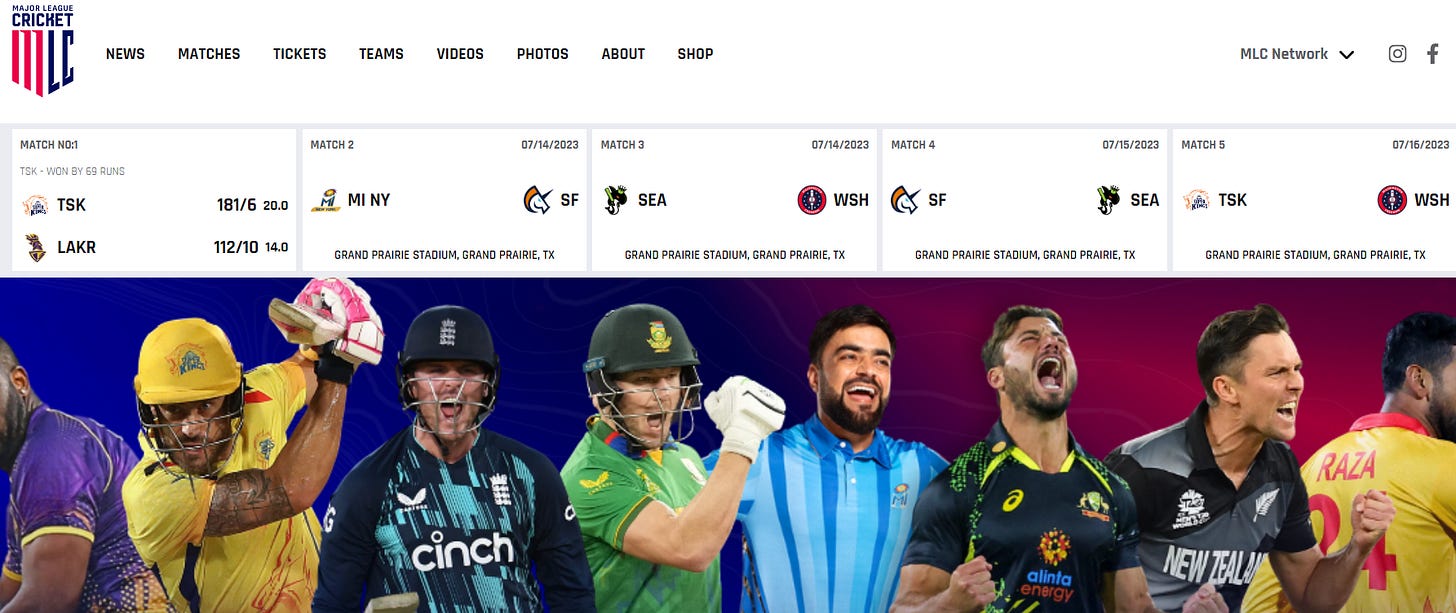

Major League Cricket

Do you know that there's an IPL-like cricket league happening right here in the USA? It's called Major League Cricket (MLC), and it's currently underway, bringing the excitement of professional cricket to American soil. If you're a cricket enthusiast looking for thrilling matches and top-class cricketing action, MLC is the event you don't want to miss.

The much-anticipated inaugural MLC match is scheduled to take place on Thursday, July 13, 2023. Mark your calendars, as a total of 18 games will be played leading up to the highly anticipated championship final on July 30. Wondering where all the action will unfold? Most of the matches will be held at the impressive Grand Prairie Stadium, located near Dallas, TX.

Curious about the teams participating and more? Follow the link.

https://www.majorleaguecricket.com/

How AI is Driving an Explosion in Entrepreneurship

Experts believe that the availability of AI tools will spark an explosion in the number of new business startups. With AI offering unprecedented capabilities to automate tasks, analyze data, and generate insights, entrepreneurs have access to powerful tools that were once exclusive to large corporations. This democratization of AI technology enables individuals to unleash their creativity and turn innovative ideas into successful ventures. The ease of implementation and the potential for cost savings make AI an attractive proposition for aspiring entrepreneurs, fueling optimism and paving the way for a surge in new businesses across diverse industries.

For immigrants, who are often known for their tenacity and drive, this AI era brings forth exciting opportunities to establish thriving businesses. With inherent work ethic and determination, immigrants are poised to take advantage of the possibilities this technological revolution has to offer. In particular, AI can serve as a valuable technical partner for budding entrepreneurs, empowering them to realize their dreams and plan ahead for success.

The Rise of AI and Business Growth: AI technology has permeated various sectors, from finance and healthcare to manufacturing and customer service. Its ability to process vast amounts of data, automate tasks, and generate valuable insights has significantly transformed the business landscape. Immigrants, renowned for their resourcefulness, can harness AI to overcome challenges and gain a competitive edge in the market.

Unlocking Opportunities: One of the significant advantages of the AI era for immigrant entrepreneurs is the vast scope of opportunities that arise. AI-powered tools and platforms enable them to streamline operations, optimize processes, and enhance decision-making. From predictive analytics and machine learning to chatbots and virtual assistants, AI offers a range of solutions that can revolutionize how businesses are run.

Technical Partnership with AI: For many aspiring entrepreneurs, technical expertise can be a hurdle in launching a successful business. However, AI serves as an invaluable partner, bridging the gap between ambition and execution. With AI as their technical ally, entrepreneurs can focus on their core strengths while harnessing the power of AI for efficiency, productivity, and growth.

Planning Ahead with AI: AI's predictive capabilities can provide invaluable insights for entrepreneurs as they plan ahead. Immigrant entrepreneurs, known for their forward-thinking approach, can leverage AI algorithms to analyze market trends, consumer behavior, and competition. By harnessing these insights, they can make informed decisions, devise effective strategies, and position their businesses for success in an ever-evolving market.

Collaboration and Knowledge Sharing: The AI era also fosters collaboration and knowledge sharing within the immigrant entrepreneur community. Online platforms and forums enable them to connect, learn from each other's experiences, and gain exposure to cutting-edge AI applications. By building a supportive network, immigrants can exchange ideas, share best practices, and leverage collective wisdom, further enhancing their chances of success.

#SettleWiseStance – If you have a business idea and are looking to start or grow your venture, exploring AI tools can greatly enhance your chances of success. The advancements in artificial intelligence have opened up a world of possibilities for entrepreneurs, providing them with powerful tools and insights to drive innovation and efficiency. By leveraging AI technology, you can automate processes, analyze vast amounts of data, and gain valuable insights that can shape your business strategy. SettleWise is here to support you on your entrepreneurial journey, offering assistance and guidance in utilizing AI tools effectively. We understand the potential that AI holds for businesses and are ready to lend a helping hand to ensure your success. If you have any specific question, reach out to us via comments or email to author.settlewise@gmail.com

Wiser Craving

Multiple subscribers reached out expressing their interest of learning few specific topics. If you want to read about any specific topic, Please let me know in the comments or email to author.settlewise@gmail.com

#WiserCraving Topic of this edition is How to transfer money from/to USA.

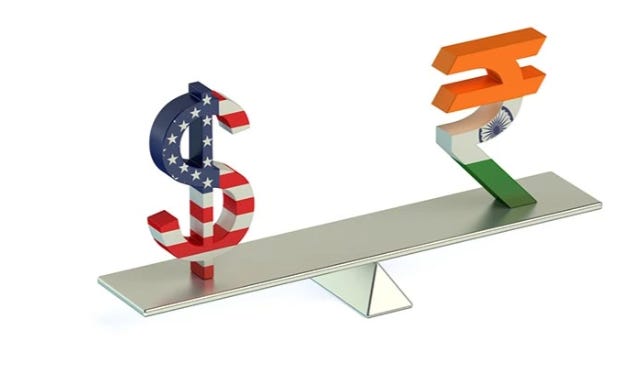

How to transfer money from/to USA

Most of us know how to transfer money from USA. To send dollars to India, there are several reliable and convenient methods available. One popular option is to use international money transfer services such as Xoom, Remitly. These services allow you to transfer funds online or through their mobile apps, providing a quick and secure way to send money. It's important to compare fees and exchange rates when choosing a service or bank to ensure you get the best deal. Additionally, consider using reputable and well-established providers to ensure the safety and timely delivery of your funds.

When it comes to how to transfer money to USA, we understand that there has been a lot of confusion surrounding the taxation on the repatriation of funds from India, especially after the first of July 2023. Today, we aim to address this issue and provide clarity.

To begin, let's clarify some key points. NRIs are individuals who are residents outside of India as per the FEMA regulations. It includes OCI holders as well. These individuals can only maintain NRO, NRE, and FCNR bank accounts. They are not permitted to have regular resident savings accounts or deposits.

Now, let's see the provisions of the Income Tax Act, specifically Section 206C(1G), which deals with the applicability of TCS (Tax Collected at Source) on repatriation of funds. TCS applies when three conditions are cumulatively satisfied: 1) the person is a resident individual, 2) they purchase foreign currency from an AD Banker, and 3) they repatriate the purchased foreign currency to a person or country outside of India under the liberalized remittance scheme (LRS).

It's important to note that TCS applies only to repatriation under the LRS and is applicable solely to resident individuals. NRIs, who repatriate funds, are not subject to TCS as it only applies to residents using the LRS. NRIs have their own scheme, the one million dollar scheme, for repatriating money. Therefore, the entire NRI community is exempt from this provision.

However, there is a crucial issue that needs attention. Despite our efforts to educate immigrants about the dos and don'ts regarding bank accounts, many still maintain savings accounts meant for resident Indians. Repatriating funds from these resident accounts is a violation of FEMA regulations. To rectify this, it is crucial to convert these accounts into NRO accounts before attempting to repatriate funds. We urge NRIs to convert their resident savings accounts into NRO accounts at the earliest possible time. Failure to do so can lead to severe penalties under FEMA.

Let's address the confusion surrounding TCS. TCS, which stands for Tax Collected at Source, is not the final tax amount that you have to pay. It is a preventive measure to collect taxes in advance. When purchasing foreign currency, the AD Banker will collect an additional 5% or 20% as TCS, depending on the case. This amount is then deposited on your behalf to the government's account as income tax.

When filing your tax returns, you can claim the TCS as tax paid in advance and offset it against your tax liability. If you are not liable to pay taxes or if you have already paid excess tax, you can claim a refund. It's crucial to note that TCS does not mean you have to pay 20% taxes on your overall costings. Your tax liability depends on your income in India and is determined by your slab rate. The final tax calculation will be done when you file your tax return.

Regarding the amendments, there are four distinct categories to consider:

1. Repatriation of funds for educational purposes with an education loan: TCS applies at 0.5% if the aggregate remittance outside India exceeds seven lakhs in a financial year. This rule remains unchanged.

2. Repatriation of funds for self-funded education or medical treatment: TCS applies at 5% if the aggregate remittance exceeds seven lakhs in a financial year. This rule also remains unchanged.

3. Payments for overseas tour packages: Until 30th June 2023, TCS applies at 5% without any threshold. However, after 30th June, the rate increases to 20% without any threshold.

4. Any other remittance under LRS by a resident individual: Until 30th June 2023, TCS applies at 5% if the remittance exceeds seven lakhs in a financial year. After 30th June 2023, there is no threshold, and the TCS rate increases to 20%.

#SettleWiseStance – To summarize, the recent amendments primarily impact two categories: those going on vacation and those making remittances under the LRS. For NRIs, the status quo remains unchanged. It's important to avoid any confusion or hasty repatriations, as these changes do not apply to NRIs, NRO accounts, NRE accounts, or FCNR accounts.

Its always good to work with a auditor and plan ahead of any plan for big money movements. As there is a yearly cap on most of the schemes, your auditor may guide you to move the money in parts that fits within the yearly cap. So that you can pay zero or less tax.

FREE chance to win Millions!

Exciting news for lottery enthusiasts! The jackpot prizes for Mega Millions and Powerball are soaring to new heights, creating an immense opportunity for lucky winners. With each passing draw, the jackpot amounts continue to escalate, capturing the attention and imagination of people around the world. Currently Mega Millons sitting at $560,000,000 and Powerball at $875,000,000. The potential to win life-changing sums of money has never been greater. If you've ever dreamed of hitting the jackpot and experiencing a new level of financial freedom, now is the time to try your luck. Settlewise is offering a chance to play it for free, giving you the opportunity to participate in these massive jackpots without any cost. Don't miss out on this incredible opportunity – click the link https://jackpocket.com/ to claim your free play and who knows, you could be the next big winner! Good Luck.

We value your feedback! Please take a moment to share your thoughts on this episode and let us know what topics you would like to read about next. Your input guides us in delivering valuable and relevant content. Feel free to leave your feedback in the comments below.

Thanks for reading SettleWise! Was this email forwarded to you? That's wonderful! It shows how much they value you and believe that you would benefit from the content. Subscribe for free to receive new posts and support my work.

Disclaimer: I am not a certified professional in the fields discussed. The content provided in this article is for educational and entertainment purposes only. The opinions and suggestions shared are intended to provide general information and assist you in making informed decisions. Please note that while I may mention specific products or services, I may earn referral income from some of the links provided, but no additional cost to you. Therefore, while you can continue reading and absorbing the information, please exercise your own judgment and seek professional advice when necessary. Please gamble responsibly and with caution, as playing the lottery involves chance and there are no guaranteed outcomes